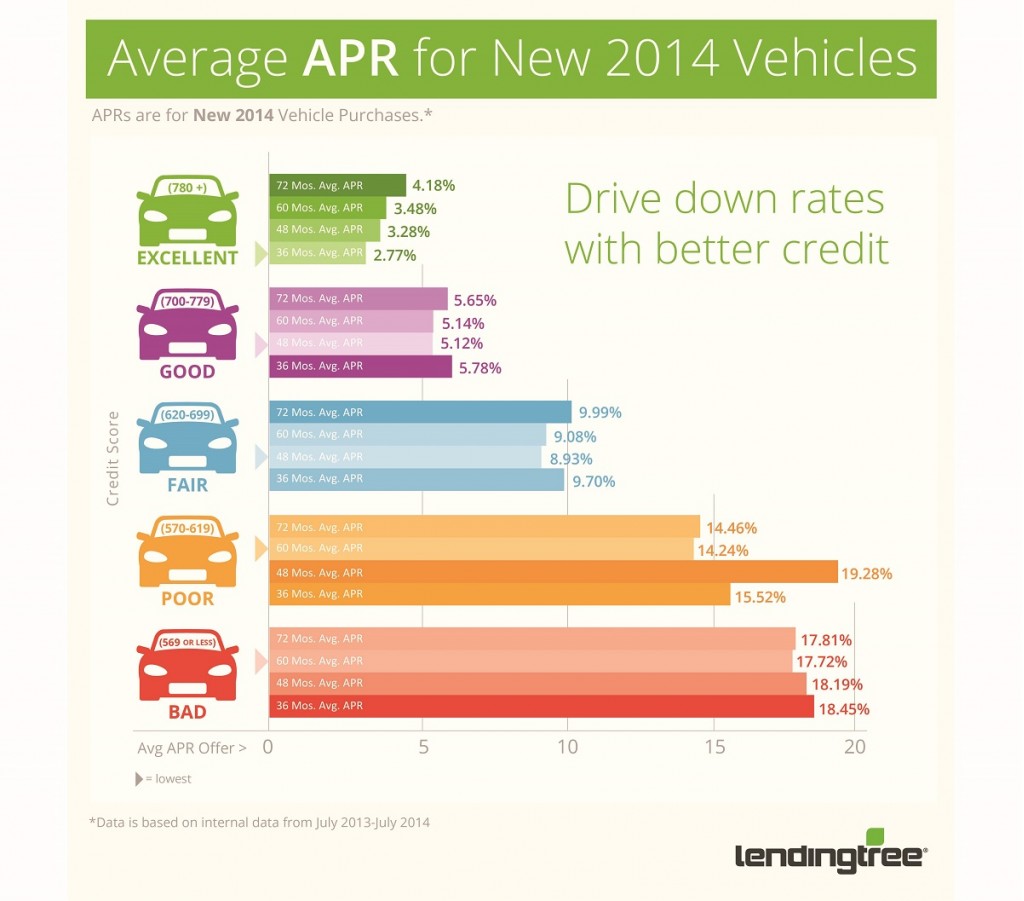

You can also browse average auto loan rates based on credit score to determine what you might be qualified for.Įven if you don’t know the fees that will come with your auto loan, you can still estimate costs based on these common fees: To qualify for this, you’ll need to have good credit - typically 670 or higher. The average interest rate on a new car loan was 3.54% as of May 2021. Interest rate is the most important factor when it comes to your auto loan payment.Most dealerships and lenders offer terms between 24 months to 84 months, or two to seven years. Loan term is how long you plan on making monthly payments.This will get you to the total loan amount. Then add the estimated sales tax you’ll need to pay to the purchase price. Subtract the trade-in value of your current vehicle and the amount of your down payment. Loan amount is based on how much you plan on borrowing.You can adjust your loan term and interest rate to estimate another monthly car payment. The auto loan calculator will estimate your monthly loan payment and total amount of interest charged by the lender.

#Car loan payment calculator with credit score how to

How to use our auto loan calculatorĮnter your loan amount, loan term and interest rate. You can adjust the amount you borrow, your loan term and your interest rate to see how your monthly payment and overall cost change. Our auto loan calculator will help you estimate how much a car will cost you.

Best debt consolidation loans of September 2023.JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. Insurance products are made available through Chase Insurance Agency, Inc. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC.

Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Past performance is not a guarantee of future results. Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. "Chase Private Client" is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking℠ account. is a wholly-owned subsidiary of JPMorgan Chase & Co. “Chase,” “JPMorgan,” “JPMorgan Chase,” the JPMorgan Chase logo and the Octagon Symbol are trademarks of JPMorgan Chase Bank, N.A. That way you’ll be better able to estimate how much you can afford while shopping for the right car for you.

Your monthly payment will be determined by the vehicle cost, loan term and APR (annual percentage rate) - which is highly dependent on your credit score. How does a monthly car payment calculator work?Ī monthly car payment calculator takes your loan details and turns them into projected monthly payments. You can use a car payment calculator to estimate your monthly car payments and ensure it fits in your budget before visiting your local dealership. If you’re shopping for a new or used car, you may be looking to project your monthly payments before making it official. Before shopping for your next car, it’s an important part of the car buying process to prepare for what the cost may look like.

0 kommentar(er)

0 kommentar(er)